To kick off the Financial Applications section of the MCF3M course, I wanted to introduce students to a simple interest problem in a way that helped them see what skills they already possess when it comes to interest rates, percentages, and problem solving. I saw this post from Dan about Rent-to-Own companies and thought it was a great application. I took a look through the EasyHome flyer and off we went.

I figured the Nintendo Switch Dock would be a relatable problem. First, I had students share what they knew or noticed and then what they wondered. Their thoughts and wonderings led us well into the core question for the day:

What Interest Rate is Easy Home charging?

I had used the posted interest rate on EasyHome to find the “retail price” they claim and gave that information to the students.

Total Price: $19 per week for 104 weeks

EasyHome’s Retail Price: $1,236.55

Students hadn’t seen any lessons about interest or seen any interest rate formulas at this point so they were using pure problem solving and prior knowledge to solve. Up at the blackboards, groups worked together to solve for the interest rate.

All were able to solve for the total interest charged pretty quickly. It took some guided conversations for students to get the interest rate: 29.9%/annum.

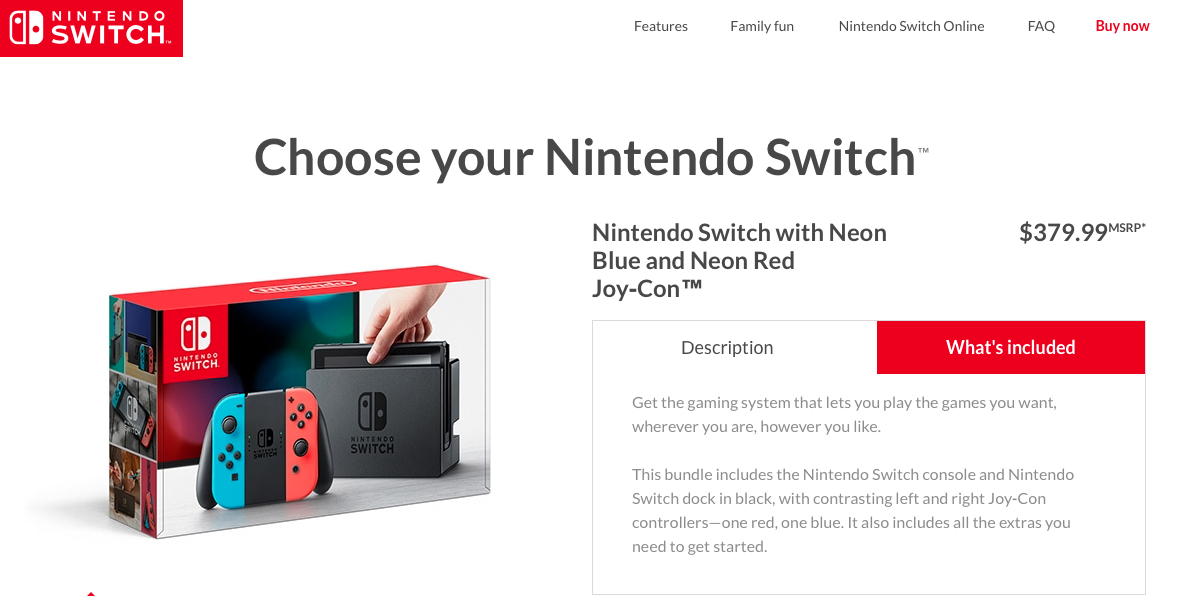

Then came the more interesting part of the problem. I asked students how much a Nintendo Switch actually costs to buy outright and it quickly dawned on them that the retail price EasyHome was claiming was way over the MSRP.

After providing them with this image, I asked students to solve for the actual interest rate being charged by EasyHome to see if it qualified as a criminal rate of interest under National Law usury under the Criminal Code of Canada (60%).

Students went right to work redoing the problem with the new Principal.

210%!

I mean, I expected it to be high. But 210%? It really is criminal.

The students were really engaged & enraged throughout this activity and it was a great entry point into learning about simple & compound interest situations.

The basic Google Slides presentation I used can be found here. A second version with PearDeck integrated is here.

Happy investigating!